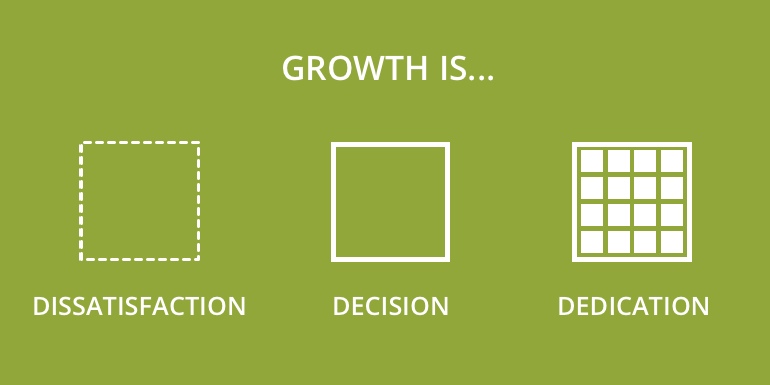

Every day we make decisions to live a life of our choosing. But yet, when asked about what our ideal life could look like, it’s often quite different from the one we’re living right now. Our decisions link our current life to the life we’d like. With every decision, we’re either establishing a new boundary,...Continue reading

From bags to riches

We often think of things like stocks, bonds, mutual funds, annuities and assets as investments. But, investments are a broad area. According to Investopedia, an investment involves putting capital to use today to increase its value over time. An investment requires putting capital to work, in the form of time, money, effort, etc., in hopes...Continue reading

Want to avoid a lapsed policy?

When the purse strings are pulled tight, it’s challenging to look at your statement and see monthly amounts deducted for insurance payments. Whether the risk policies are for health care, income protection or the protection of assets, seeing them come off your account can be painful. As a result, many of us cut these policies...Continue reading

When you think you can’t

Stress can be an incredibly powerful motivator. Most of the time, we see it as a negative, but that’s because our days are generally overwhelmed with stress. And, our coping skills have evolved to help us survive in environments very different (Cosmides & Tooby, 2013). Our mind protects us from harm and further stress by...Continue reading

What’s happening in the markets?… is not always the best question

Whilst it’s good to have someone on your team (your financial adviser) who knows what’s happening in the markets, it’s not always helpful to relay all that information to you and have you make decisions about it. We can’t control the markets, but we can control our conversations about money. That’s why it’s not always...Continue reading

It’s okay to listen and learn

Over the last two decades, we’ve been introduced, seduced and held captive by the overwhelming presence of digital communication. From the days when we promised ourselves we would ‘never get emails on our Blackberry’ to an age where we can DM, post, comment, react, share, support, subscribe, pin, tweet, self-publish, sync, stream, webcast, update, upload...Continue reading

When the markets have you second-guessing

“Genuine travellers travel not to overcome distance but to discover distance.” James P Carse Investing money is always a paradox: it’s simple, complex, straightforward, challenging, mathematical, and unpredictable. It’s because of our emotional influence that plays a significant role in every decision we make. When investing in the markets, many have said it’s all about...Continue reading

The Superman Syndrome

Have you ever watched a superhero movie where they show the origin story of the hero? It’s often a journey of going from ordinary and wanting so much more, to being extra-ordinary and not being able to cope with all of the responsibility. A sense of overwhelming obligation can both distract and dilute the hero...Continue reading

Car insurance and your financial portfolio

When the effects of inflation are being felt more than ever, and global economies are stuck in a state of recovery, it’s common for us to sit down and review our monthly expenses in a fervent drive to reduce our expenses. As we scroll through our bank statements or budgeting apps, we will start to...Continue reading

Fight or flight – freeze or appease?

We all have reactionary instincts, which can be quite different in various situations. We won’t always run from certain challenges (flight) or panic when confronted with a problem (freeze). Sometimes we may stand our ground and represent our deep values (fight), but in other cases, we could simply go with the flow in order to...Continue reading

We can only change what we can observe

One of the frustrations that we often experience is the feeling of being stuck. We repeat the same patterns, day in and day out, forming habits that we seem unable to shake. From unhealthy eating, exercise and money choices to self-sabotaging social media, phone and relationship habits, it’s easy to find ourselves living a life...Continue reading

Doing everything yourself?

There are many reasons why we try to do everything ourselves, from satisfying our need to be in control to trying to save costs, or simply “wanting the job done right”, all of us find ourselves doing too much when we forget, or haven’t learned to delegate. Taxes and financial planning are two areas that...Continue reading